Price models and market models

Value-based pricing involves setting prices based on understanding what customers value and what they will pay for. To find the optimum price points requires pricing models to be built based on estimates of demand from price tests, or from research surveys using conjoint analysis, Brand price trade-off research and pricing research

What is a pricing model?

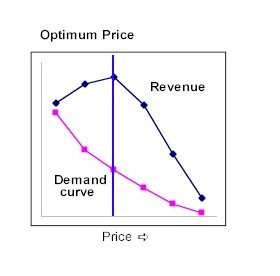

A pricing model can be as simple as a demand curve (pricing as opposed to price model as the model often extends to multiple factors and products). A demand curve is the plot of cumulative demand - using the assumption that if someone will pay $50, they would also pay $40 and $30 and so on - at each possible price point. The use of cumulative measure gives a demand 'curve' (often it's a straightish line).

A pricing model can be as simple as a demand curve (pricing as opposed to price model as the model often extends to multiple factors and products). A demand curve is the plot of cumulative demand - using the assumption that if someone will pay $50, they would also pay $40 and $30 and so on - at each possible price point. The use of cumulative measure gives a demand 'curve' (often it's a straightish line).

Our pricing explorer provides an interactive example to explore why businesses need to understand customer demand.

By multiplying the demand by the price, this can then be converted into a revenue curve. Commonly, the revenue curve shows a maximum, where a higher price causes a drop in willingness-to-pay so reducing revenue, while a lower price will not increase demand sufficiently to offset the price reduction. This is the revenue maximisation price.

However, revenue is not necessarily profit. For the same chart, fixed and variable costs can be added allowing the estimation of a profit curve. Profit maximisation prices are often different from revenue maximisation prices, and at low prices - where variable costs are not covered, or very high prices where demand is low and fixed costs are not covered, the potential profit can be negative.

These simple analyses start to define the potential optimum price points, and the range of appropriate prices available in the market.

However, the choice of what price to set, will also depend on underlying strategic considerations. For new entrants to a market, the aim may be to attempt to win customers with a strong value proposition, aiming to capture market share. Consequently, pricing would be on the value side of the optimum for market penetration.

For established players, pricing may be more sophisticated and adjust over time. For instance, setting high prices for early buyers (eg Apple products, or film and fashion industries) to skim early profits and establish premium positioning, before reducing prices later for market volume.

In most cases the pricing specialist will want to look at more than one curve; for instance for significant market segments or to investigate potential for promotional or discounts to target different groups, or in the most sophisticated models, to look at dynamic pricing where early buyers might pay a lower price and late buyers a higher price in order to optimise yield.

Benefits of market models

In complex markets, prices are rarely a single dimensional demand curve. Demand depends on factors like competition, features of a product, distribution, service levels, and brand awareness and brand image.

While for most market research, information is presented in the form of a static display of statistics and charts, trade-off and pricing research, requires the ability to model the market under different scenarios, and to see what the likely impact of decisions would be, and how these might change according to competitor responses.

Full pricing models allow for a more sophisticated use of price within a market and when planning a market entry strategy, or evaluating price competition, and can be combined with estimates of cost and investment to understand potential market returns.

Models therefore allow direct live interaction and estimation, but can also be used with optimisation tools that search for price and feature optimisations, either on an individual product, or considering a range of products in terms of market coverage and return. Value-based pricing is not just about pricing to meet customer value points, but also understanding what those value points are and delivering the requisite products and services.

Example conjoint model

Conjoint analysis is the most sophisticated market research method for estimating demand for products and services with differing prices and features. There are many flavours of conjoint analysis, but all conjoint analysis leads to a market model where prices and features can be varied and so the impact of product or price changes can be assessed to understand different business options prior to going to market.

Our demonstration conjoint analysis model allows different product values to be selected and then their impact calculated on market preference. The normal use of these types of model is to understand the potential ROI on different features or projects and to see what would be optimised market positioning, or optimised return to the business.

Pricing research models and other models

Market research for pricing and pricing models are excellent tools for forecasting prices as a business is limited in the way in which it can adjust price for real in a market. However, any research-based data should be validated and compared to real sales and real customer behaviour.

In the same way that models can be drawn from market research data, they can also be built from database and promotional data. It is possible for instance, for a company to use promotions to test price sensitivity, or to use split pricing tests to investigate real reactions to price so long as this is done with modelling in mind. These might include experimental testing for price variations to validate pricing maxima.

For help and advice on carrying out and custom designed pricing research or pricing analysis contact info@dobney.com